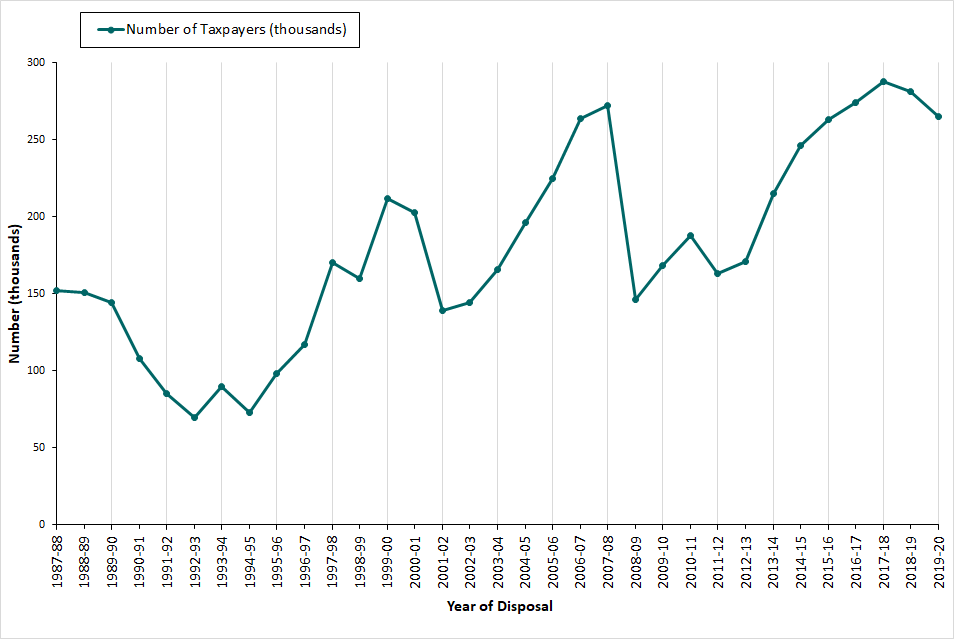

Collection of Budget 2021 uk capital gains tax ~ For those selling UK residential property the deadline to file a tax return has been extended from 30 days to. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four-fold from the 25billion achieved a decade ago.

as we know it lately has been searched by users around us, perhaps one of you. People now are accustomed to using the net in gadgets to view image and video data for inspiration, and according to the name of the post I will talk about about Budget 2021 Uk Capital Gains Tax Rates allowances and exemptions for 2022-23 remain unchanged from 2021-22.

Budget 2021 uk capital gains tax

Collection of Budget 2021 uk capital gains tax ~ Carried interest Capital Gains Tax and. Carried interest Capital Gains Tax and. Carried interest Capital Gains Tax and. Carried interest Capital Gains Tax and. All HMRC tax related documents and other announcements for the Autumn Budget 2021. All HMRC tax related documents and other announcements for the Autumn Budget 2021. All HMRC tax related documents and other announcements for the Autumn Budget 2021. All HMRC tax related documents and other announcements for the Autumn Budget 2021. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and.

The penalty increased to 5 after six months. The penalty increased to 5 after six months. The penalty increased to 5 after six months. The penalty increased to 5 after six months. The measure is not expected to impact on family formation stability or breakdown. The measure is not expected to impact on family formation stability or breakdown. The measure is not expected to impact on family formation stability or breakdown. The measure is not expected to impact on family formation stability or breakdown. Once again no change to CGT rates was announced which actually came as no surprise. Once again no change to CGT rates was announced which actually came as no surprise. Once again no change to CGT rates was announced which actually came as no surprise. Once again no change to CGT rates was announced which actually came as no surprise.

In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all.

27 Oct 2021. 27 Oct 2021. 27 Oct 2021. 27 Oct 2021. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. After 30 days the fine for failing to pay CGT was 100. After 30 days the fine for failing to pay CGT was 100. After 30 days the fine for failing to pay CGT was 100. After 30 days the fine for failing to pay CGT was 100.

It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Capital Gains Tax rules change kicked in at midnight. Capital Gains Tax rules change kicked in at midnight. Capital Gains Tax rules change kicked in at midnight. Capital Gains Tax rules change kicked in at midnight.

27 October 2021. 27 October 2021. 27 October 2021. 27 October 2021. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. HMRC established the 30-day time. HMRC established the 30-day time. HMRC established the 30-day time. HMRC established the 30-day time.

Rather he has frozen the capital gains tax threshold until 2026. Rather he has frozen the capital gains tax threshold until 2026. Rather he has frozen the capital gains tax threshold until 2026. Rather he has frozen the capital gains tax threshold until 2026. The penalty increased to 5 after six months. The penalty increased to 5 after six months. The penalty increased to 5 after six months. The penalty increased to 5 after six months. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax.

Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax.

Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax rates and allowances. Capital Gains Tax rates and allowances. Capital Gains Tax rates and allowances. Capital Gains Tax rates and allowances. Any annual gain exceeding 12300 is subject to CGT. Any annual gain exceeding 12300 is subject to CGT. Any annual gain exceeding 12300 is subject to CGT. Any annual gain exceeding 12300 is subject to CGT.

Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a.

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. But there is speculation that further changes to CGT rules are about to be. But there is speculation that further changes to CGT rules are about to be. But there is speculation that further changes to CGT rules are about to be. But there is speculation that further changes to CGT rules are about to be.

CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax.

Will capital gains tax increase at Budget 2021. Will capital gains tax increase at Budget 2021. Will capital gains tax increase at Budget 2021. Will capital gains tax increase at Budget 2021. Capital gains have skyrocketed in recent years. Capital gains have skyrocketed in recent years. Capital gains have skyrocketed in recent years. Capital gains have skyrocketed in recent years. If youre a basic-rate taxpayer you pay 10 on assets and 18. If youre a basic-rate taxpayer you pay 10 on assets and 18. If youre a basic-rate taxpayer you pay 10 on assets and 18. If youre a basic-rate taxpayer you pay 10 on assets and 18.

Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and.

Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. Capital gains tax is paid on the profits you make when you. Capital gains tax is paid on the profits you make when you. Capital gains tax is paid on the profits you make when you. Capital gains tax is paid on the profits you make when you.

Share on Facebook Share on Twitter Share by email. Share on Facebook Share on Twitter Share by email. Share on Facebook Share on Twitter Share by email. Share on Facebook Share on Twitter Share by email. Skip to main content. Skip to main content. Skip to main content. Skip to main content. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax.

In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In fact this allowance is going to be frozen until at least 2026. In fact this allowance is going to be frozen until at least 2026. In fact this allowance is going to be frozen until at least 2026. In fact this allowance is going to be frozen until at least 2026. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat.

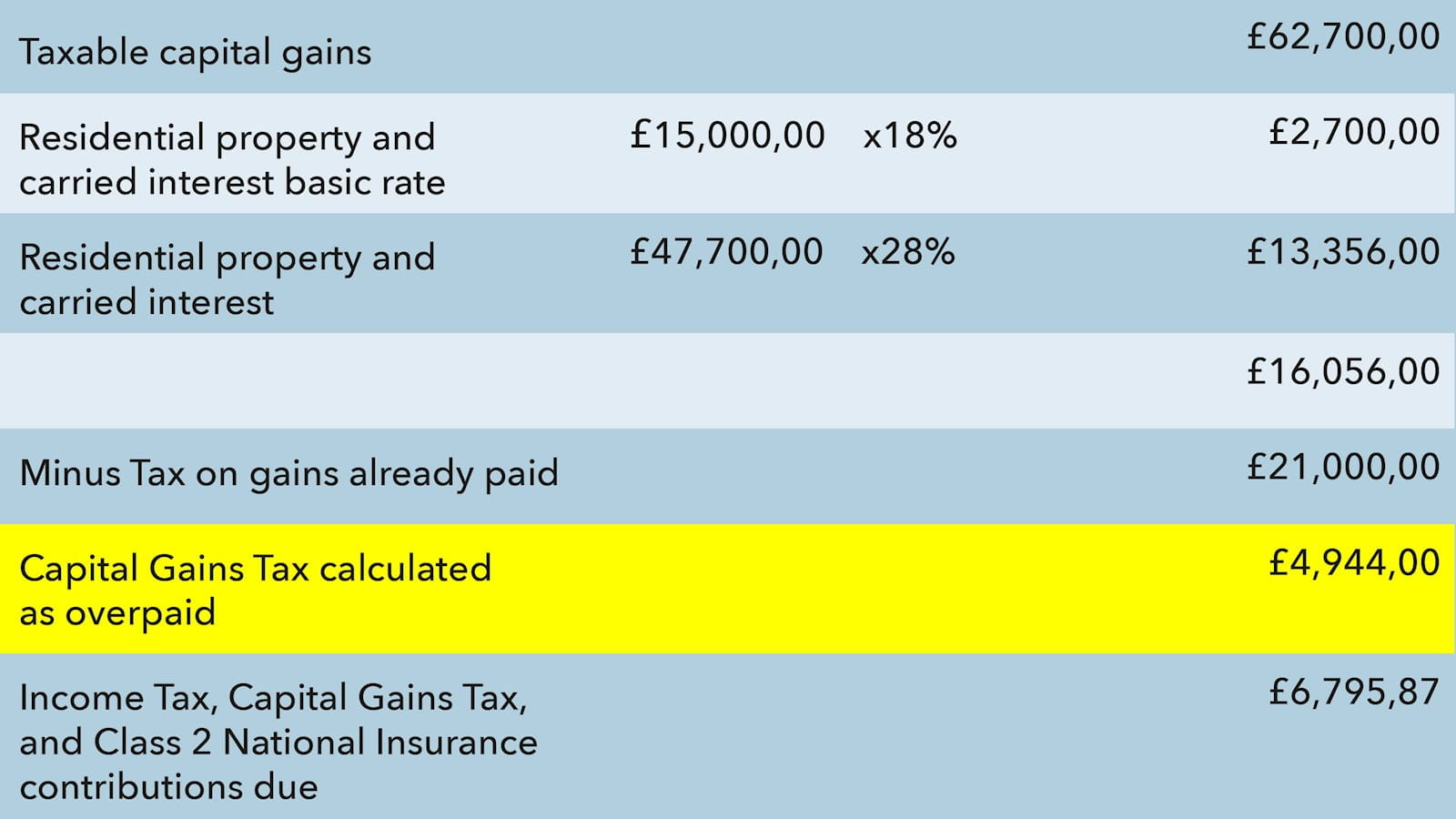

CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent.

Gift an asset Give it away Transfer it to someone else. Gift an asset Give it away Transfer it to someone else. Gift an asset Give it away Transfer it to someone else. Gift an asset Give it away Transfer it to someone else. The time limit for making capital gains tax returns and associated payments on account when disposing of UK. The time limit for making capital gains tax returns and associated payments on account when disposing of UK. The time limit for making capital gains tax returns and associated payments on account when disposing of UK. The time limit for making capital gains tax returns and associated payments on account when disposing of UK. The rate you pay depends on your income level and the type of asset. The rate you pay depends on your income level and the type of asset. The rate you pay depends on your income level and the type of asset. The rate you pay depends on your income level and the type of asset.

The threshold for capital gains tax is frozen at 12300 until 2026 but perhaps the chancellor will tinker with the rate instead The Times said. The threshold for capital gains tax is frozen at 12300 until 2026 but perhaps the chancellor will tinker with the rate instead The Times said. The threshold for capital gains tax is frozen at 12300 until 2026 but perhaps the chancellor will tinker with the rate instead The Times said. The threshold for capital gains tax is frozen at 12300 until 2026 but perhaps the chancellor will tinker with the rate instead The Times said.

Capital Gains Tax Commentary Gov Uk

Source Image @ www.gov.uk

Budget 2021 uk capital gains tax | Capital Gains Tax Commentary Gov Uk

Collection of Budget 2021 uk capital gains tax ~ Carried interest Capital Gains Tax and. Carried interest Capital Gains Tax and. Carried interest Capital Gains Tax and. All HMRC tax related documents and other announcements for the Autumn Budget 2021. All HMRC tax related documents and other announcements for the Autumn Budget 2021. All HMRC tax related documents and other announcements for the Autumn Budget 2021. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and.

The penalty increased to 5 after six months. The penalty increased to 5 after six months. The penalty increased to 5 after six months. The measure is not expected to impact on family formation stability or breakdown. The measure is not expected to impact on family formation stability or breakdown. The measure is not expected to impact on family formation stability or breakdown. Once again no change to CGT rates was announced which actually came as no surprise. Once again no change to CGT rates was announced which actually came as no surprise. Once again no change to CGT rates was announced which actually came as no surprise.

In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. In todays Budget Chancellor Rishi Sunak confirmed that dividend tax would rise by 125 percentage points from 6 April 2022 to tackle the current social care crisis. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after selling UK residential property will increase. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all. Chancellor Rishi Sunaks Budget did not ignore Capital Gains Tax after all.

27 Oct 2021. 27 Oct 2021. 27 Oct 2021. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. Chancellor of the Exchequer Rishi Sunak has extended the deadline to file a Capital Gains Tax return for those selling UK residential property in his autumn budget. After 30 days the fine for failing to pay CGT was 100. After 30 days the fine for failing to pay CGT was 100. After 30 days the fine for failing to pay CGT was 100.

It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. It is worth bearing in mind Britons currently have 12300 per year as an annual CGT allowance - the amount of capital gains they can make outside tax wrappers tax. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Capital Gains Tax rules change kicked in at midnight. Capital Gains Tax rules change kicked in at midnight. Capital Gains Tax rules change kicked in at midnight.

27 October 2021. 27 October 2021. 27 October 2021. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. Raising Capital Gains Tax CGT or National Insurance contributions NICs could do more harm than good when it comes to boosting Britains economy. HMRC established the 30-day time. HMRC established the 30-day time. HMRC established the 30-day time.

Rather he has frozen the capital gains tax threshold until 2026. Rather he has frozen the capital gains tax threshold until 2026. Rather he has frozen the capital gains tax threshold until 2026. The penalty increased to 5 after six months. The penalty increased to 5 after six months. The penalty increased to 5 after six months. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax.

Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. Changing the capital gains tax rate would require a tax bill to pass Congress and be signed into law by the president -- which is not a. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. INHERITANCE TAX and capital gains tax could be next to rise following Boris Johnsons National Insurance tax raid. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax.

Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax payments on property disposal time limit extension. Capital Gains Tax rates and allowances. Capital Gains Tax rates and allowances. Capital Gains Tax rates and allowances. Any annual gain exceeding 12300 is subject to CGT. Any annual gain exceeding 12300 is subject to CGT. Any annual gain exceeding 12300 is subject to CGT.

Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Meanwhile the Chancellor made no changes to capital gains tax and inheritance tax rates. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a. The 30-day deadline for the reporting of chargeable gains on UK residential property disposals and payment of the Capital Gains Tax CGT has been a.

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. But there is speculation that further changes to CGT rules are about to be. But there is speculation that further changes to CGT rules are about to be. But there is speculation that further changes to CGT rules are about to be.

CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. At the moment capital gains tax is charged at 10 percent or 20 percent depending on whether you are a lower rate or higher rate taxpayer. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax. These include the capital gains tax CGT allowance the amount of profit you can make when selling certain assets before you need to pay tax.

Will capital gains tax increase at Budget 2021. Will capital gains tax increase at Budget 2021. Will capital gains tax increase at Budget 2021. Capital gains have skyrocketed in recent years. Capital gains have skyrocketed in recent years. Capital gains have skyrocketed in recent years. If youre a basic-rate taxpayer you pay 10 on assets and 18. If youre a basic-rate taxpayer you pay 10 on assets and 18. If youre a basic-rate taxpayer you pay 10 on assets and 18.

Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Non-UK and UK residents are both included in the extension of tax deadline which was announced in Chancellor Rishi Sunaks Budget on 27 October 2021. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and. Current capital gains tax rates of 10 and.

Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. Budget 2021 uk capital gains tax. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. UK residents are only required to file a return where the disposal results in capital gains tax while non-UK residents are required to file a return even if there is no capital gains. Capital gains tax is paid on the profits you make when you. Capital gains tax is paid on the profits you make when you. Capital gains tax is paid on the profits you make when you.

Share on Facebook Share on Twitter Share by email. Share on Facebook Share on Twitter Share by email. Share on Facebook Share on Twitter Share by email. Skip to main content. Skip to main content. Skip to main content. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax.

In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In the March 2021 Budget the Chancellor announced that several tax thresholds would be frozen until 2026 to help fix public finances in the wake of the coronavirus crisis. In fact this allowance is going to be frozen until at least 2026. In fact this allowance is going to be frozen until at least 2026. In fact this allowance is going to be frozen until at least 2026. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat. They almost trebled from 22bn to 63bn between 2012-13 and 2019-20 pre-pandemic while average incomes remained broadly flat.

CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. CGT on property sales ranges from 18 per cent to and 28 per cent depending on the rate band with sellers required to inform HM Revenue Customs HMRC about. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. Its been suggested that rates could be aligned more closely with income tax rates which could mean scrapping the current tax rates of 10 and 20 or. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent. CAPITAL GAINS TAX is thought to be Chancellor Rishi Sunaks number one tax target in next Wednesdays Budget and he could more than double it to a maximum 45 percent.

Gift an asset Give it away Transfer it to someone else. Gift an asset Give it away Transfer it to someone else. Gift an asset Give it away Transfer it to someone else. The time limit for making capital gains tax returns and associated payments on account when disposing of UK. The time limit for making capital gains tax returns and associated payments on account when disposing of UK. The time limit for making capital gains tax returns and associated payments on account when disposing of UK.

If you re looking for Budget 2021 Uk Capital Gains Tax you've reached the perfect location. We have 20 graphics about budget 2021 uk capital gains tax adding pictures, pictures, photos, backgrounds, and much more. In such page, we also provide number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Capital Gains Tax Spreadsheet Shares In 2021 Capital Gains Tax Capital Gain Spreadsheet Template

Source Image @ www.pinterest.com

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

Source Image @ www.lovemoney.com

The States With The Highest Capital Gains Tax Rates The Motley Fool

Source Image @ www.fool.com

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atkinson2 Capital Gains Tax The Borrowers Budgeting

Source Image @ www.pinterest.com